The Finances of Pharmaceutical Development

- Jul 11, 2025

- 7 min read

Written by Alexander Ugalde Tchinov - BSc Pharmacology at Barts and the London School of Medicine and Dentistry

It is no secret that the price of pharmaceuticals can reach seemingly extortionate levels—something that has given rise to distrust in, ridicule of, and, in extreme cases, conspiracy theories about the pharmaceutical industry (often informally referred to as "big pharma"). So, is the high price of drugs actually a result of pure corporate greed from malicious pharmaceutical executives? The short answer is not quite. While there have certainly been clear instances of excessive profit-seeking—look no further than Turing Pharmaceuticals under Martin Shkreli—there is a much more complex process behind the end price of drugs, which this article will explore.

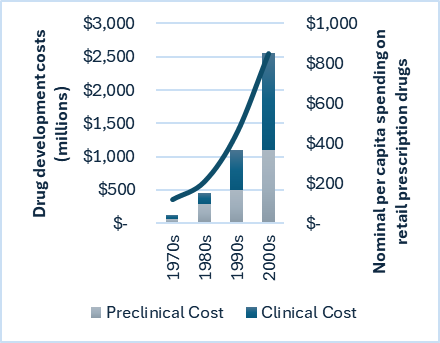

Per capita, people are undoubtedly spending more money on drugs now than at any point in history. This is a global trend led primarily by the USA. Inflation accounts for part of this increase, but interestingly, when graphed (fig.1), it becomes evident that the rise in spending is remarkably proportionate to an enormous increase in the cost of developing drugs. The correlation suggests that skyrocketing development costs are the primary driver of higher drug prices.

Figure 1 – Graph with bars showing the total average cost of drug development per drug, broken down into preclinical and clinical segments; and line showing average global nominal per capita spending on retail prescription drugs. (6,7)

The ultimate issue with drug development is that science, particularly molecular biology, does not bend to the whims of its researchers' financiers. The output of product and R&D divisions at pharmaceutical companies is not directly proportional to effort, management, or intelligence—or indeed any characteristic that, in other industries, would lead to a successful product. The development of nearly every new drug has been an enormous gamble, and despite the best biotechnological efforts of top scientists, it remains that way still and for the foreseeable future. This has created a situation in which, unlike almost any other industry, billions are spent on projects that may never see any form of return.

Furthermore, there often exists a difference in approach between the pharmaceutical scientists working in the R&D sections of these companies and their colleagues on the business and management side. An art has been formed of how to keep the most intelligent people motivated in light of the crushing fact that most of their efforts will never amount to anything. Balancing the relentless pursuit of scientific discovery with the pragmatic demands of business is a delicate task.

Figure 2 - News-Medical

The sharp increase in drug development costs comes primarily from the clinical phase, which has grown in its share of development expenditure from approximately 30% compared to preclinical costs in the 1980s to over 130% in the 2000s. This means that clinical trials now cost significantly more than the preclinical development phase. This trend was further exacerbated in the 2010s and can be predominantly attributed to increasingly stringent regulatory requirements across all world regions. This ultimately boils down to the fact that the healthcare sector, under which pharmaceuticals fall, is one of the most heavily regulated industries worldwide. This is most clear as the majority of drug development costs in recent years lie in the clinical stage.

As a result of this high price of drug development, mergers are extremely common in the pharmaceutical sector. The industry is dominated by large, established companies that can afford development costs and often acquire smaller companies that cannot continue with development. Few startup success stories exist, as the barriers to entry are incredibly high. This consolidation means that innovation can sometimes be stifled, and competition reduced.

Pharmaceutical companies rely on enormous cash reserves, with Goldman Sachs estimating that in 2023, the global pharmaceutical sector had $700 billion in reserves for funding research and acquisitions (1). For reference, big tech was estimated to hold reserves of only approximately $500 billion (2). This immense financial muscle allows big pharma to weather the high costs and risks associated with drug development.

This makes it very difficult to invest in startup pharmaceutical enterprises. Ninety percent of drugs entering into clinical trials fail to be approved, with the highest proportion of failures occurring at Phase III—the final and most expensive phase before approval. This results in a huge number of drugs failing after having had over $1 billion sunk into their development (table 1).

Drugs entering Phase IV, the post-marketing surveillance phase, are particularly critical, as they must succeed commercially not only to recoup their development costs but also the development costs of failed drugs. The pressure on these drugs to perform is immense, and failure can have significant repercussions for the company's financial health.

There have been efforts by authorities to minimize this, with agencies like the European Medicines Agency (EMA) streamlining drug certification across countries and organizations like the Organisation for Economic Co-operation and Development (OECD) facilitating the transferability of clinical data between regulatory jurisdictions. Just recently, in March of 2023, the UK's Medicines and Healthcare products Regulatory Agency (MHRA) unveiled a series of new measures to streamline clinical trials in the UK. However, despite these continual efforts, it appears that the cost of pharmaceutical development will only continue to rise.

Table 1 – Showing what is involved in each stage of drug development, the average number of compounds being worked with, the amount of time required and cost. This is not definitive and is only intended to provide a general rough idea of what can be expected in the development of a novel therapeutic entity.

So, thus far it seems that drug development is an impenetrable endeavour, with entry being reserved only for the biggest players. But this is not necessarily the case. Everything discussed until this point has looked at the process of developing a new drug, but there is also the category of adapting existing ones.

Not all drugs cost this much to make. Indeed, many of the most successful drugs are simply reformulated or repackaged forms of existing medications, which differ in how long the drug lasts or how it may be administered, as opposed to how the drug fundamentally works. These may come from the original manufacturer—in order to maintain an edge over generics—or from other companies producing biosimilars, usually after the expiry of a patent for a given drug. These products also possess the additional benefit of bearing less inherent risk of failure at the regulatory stage, allowing for a much greater degree of confidence that the product will make it to market. The intellectual property (IP) value of these drugs may also be incredibly valuable, as sometimes delivery mechanisms can be utilized across various medications, allowing for extra revenue streams from either application to other drugs within the company's own portfolio or licensing for use by others. Indeed, entire biotech companies exist with the purpose of developing delivery systems that may subsequently be licensed out.

Notable examples of reformulated drugs include OxyContin®, Nurofen®, Panadol®, and Procardia®. Since being brought to market, OxyContin® has generated an estimated $35 billion in revenue, despite having an estimated development cost of only $40 million (3). This illustrates the immense profitability that can be achieved with reformulated drugs.

Figure 3 - CDC

Beyond reformulated drugs, there are also biosimilars and generics—the medications that come to market once the patent for a novel drug has expired. Generics are much cheaper than their branded counterparts and play a crucial role in making medications more accessible to the public.

The primary notable downside of these drugs is that their success may be limited by market saturation of biosimilars, so they lean heavily on brand recognition and marketing—something that is heavily regulated in certain countries, especially those with universal healthcare provisions. These drugs are much easier to get into, and many small to mid-sized pharmaceutical companies rely on these as the backbone of their business.

Furthermore, there are development projects run by non-profit academic and governmental institutions such as the Wellcome Trust, Gates Foundation, the UK's National Institute for Health and Care Research (NIHR), and the USA's National Institutes of Health (NIH). These projects usually result in markedly more affordable medications due to their non-requirement for profitability. They play a vital role in addressing public health needs that may not be profitable for private companies to pursue. Having said that, it should be noted that the NIHR in particular have demonstrated incredible returns on their investments, expected to generate £20bn from a spend of £1.3bn (for the period of 2022-23) (4).

Needless to say, for large-scale investors, it's relatively easy to enter the pharmaceutical space and enjoy large returns, particularly if they invest diversely. The sheer scale of the industry and the potential for high profits make it an attractive proposition. For medium and small-scale investors looking for something to sink their teeth into, it is slightly more complicated. A good option is to take note of the patent expiry date of a pharmaceutical of interest and see if there are any particular operations underway in bringing a biosimilar or reformulation to market. For those with large appetites for ambition and high-risk tolerances, I'd recommend keeping an eye on any R&D scientists departing from the pharmaceutical titans to form their own companies, as often these have the best shot of evolving into an enterprise capable of bringing a blockbuster drug to market—or at the very least, intellectual property that can be licensed.

As for the safest bet a small to mid-sized investor has of successfully entering the pharmaceutical space, I'd look for a company that has promising IP and a drug nearing the end of a very promising Phase III trial, so as to be most confident that the product has a chance of entering the market. Companies like Biosplice Therapeutics (5), for instance, are worth watching closely.

In conclusion, while the high price of drugs is not solely the result of corporate greed, it reflects the complex, risky, and expensive process of drug development. The stringent regulatory environment, the high failure rate of clinical trials, and the enormous financial resources required all contribute to the end cost of pharmaceuticals. However, opportunities do exist for investors at various scales, particularly in areas like reformulated drugs, biosimilars, and generics, or by backing innovative startups with promising IP. The pharmaceutical industry remains a challenging but potentially rewarding field for investment.

Sources:

Pharmaceutical companies have $700 billion for acquisitions and investment | Goldman Sachs [Internet]. [cited 2024 Sep 10]. Available from: https://www.goldmansachs.com/insights/articles/pharmaceutical-companies-have-700-billion-for-acquisition 2. War Chest: Exploring the Cash Holdings of Big Tech [Internet]. [cited 2024 Sep 10]. Available from: https://www.capitaladvisors.com/war-chest-exploring-the-cash-holdings-of-big-tech/ 3. ‘You want a description of hell?’ OxyContin’s 12-hour problem #InvestigatingOxy - Los Angeles Times [Internet]. [cited 2024 Sep 10]. Available from: https://www.latimes.com/projects/oxycontin-part1/ 4. NIHR Annual Report 2022/23 | NIHR [Internet]. [cited 2024 Sep 20]. Available from: https://www.nihr.ac.uk/reports/nihr-annual-report-202223/34501 5. Pipeline | Biosplice [Internet]. [cited 2024 Sep 21]. Available from: https://www.biosplice.com/clinical-development/default.aspx 6. Why the US Spends More Per Person on Prescription Drugs Than Other Countries | The Fiscal Times [Internet]. [cited 2024 Sep 10]. Available from: https://www.thefiscaltimes.com/2017/08/29/Why-US-Spends-More-Person-Prescription-Drugs-Other-Countries 7. Tufts-Study-Finds-Big-Rise [Internet]. [cited 2024 Sep 10]. Available from: https://cen.acs.org/articles/92/web/2014/11/Tufts-Study-Finds-Big-Rise.html |